We use cookies to ensure you get the best experience on our website. For more details, refer to our cookie policy and privacy policy.

November 25, 2025

5

minutes

What is gamification for fintech apps and top examples

Discover 5 gamification strategies in fintechs like leaderboards, progress bars, and badges, and learn how you can enhance your app's user engagement.

Aarzu Kedia

.jpg)

Financial apps face a unique challenge. Money management is essential but often feels tedious. Users download budgeting apps with good intentions, then abandon them within weeks.

Gamification for fintech apps is the strategic use of game mechanics like rewards, progress tracking, leaderboards, and challenges to make financial tasks more engaging and motivating. It transforms routine banking activities into rewarding experiences that drive user retention and build lasting financial habits.

Gamification changes this by tapping into our natural desire for achievement, progress, and recognition, making financial responsibility feel rewarding instead of restrictive.

TL;DR:

- Gamification for fintech apps uses game mechanics (points, badges, streaks, leaderboards) to make financial tasks engaging

- 73% of users are more likely to engage with gamified financial apps compared to traditional banking interfaces (according to Deloitte's 2024 Digital Banking Report)

- Best fintech gamification strategies include spin-the-wheel rewards (CRED), competitive leaderboards (Revolut), progress tracking (Intuit Mint), achievement badges (Fortune City), and streak mechanics (CoinDCX)

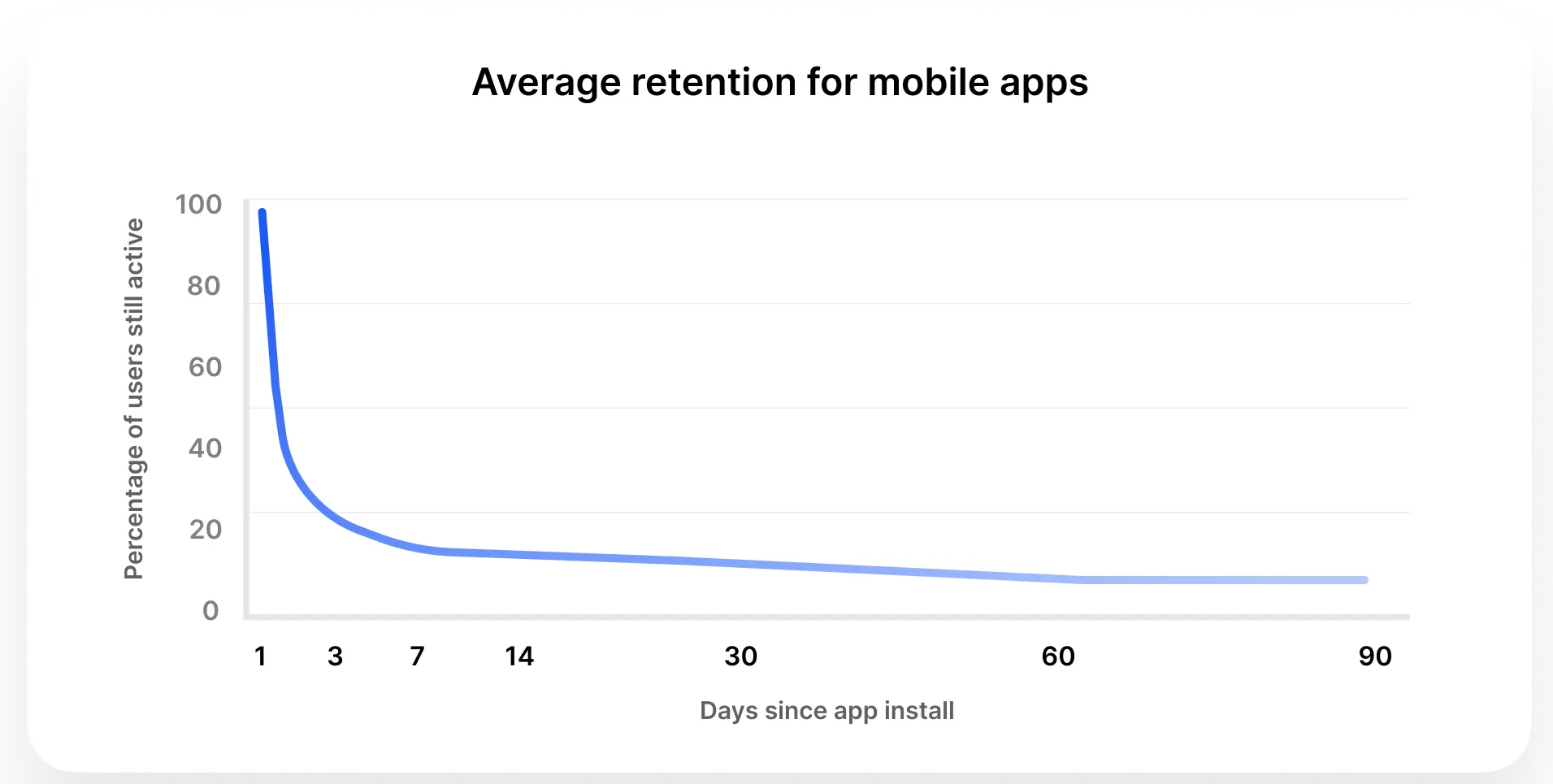

- Apps using gamification see 47% higher retention rates in the first 90 days compared to non-gamified alternatives

- No-code platforms like Plotline let fintech teams launch gamification features in days, not months

Why Use Gamification in Fintech Apps?

The benefits go beyond surface-level engagement. Here's what fintech gamification delivers:

Simplifies complex topics.

Financial literacy is intimidating. Gamified content like interactive calculators, short videos, and reward-based challenges break down complex concepts like compound interest, credit scores, and investment diversification into digestible, engaging experiences.

Builds lasting habits.

According to behavioral psychology research, it takes 66 days on average to form a new habit. Streak mechanics and daily check-in rewards keep users coming back during that critical habit-formation window.

Boosts engagement dramatically.

Research from Zuora shows that gamified fintech apps see 30-40% higher daily active user rates compared to traditional interfaces. The action-reward mechanism triggers dopamine release, reinforcing positive financial behaviors.

Creates community and healthy competition.

Leaderboards foster a sense of belonging and friendly rivalry. When users see their peers saving more or investing consistently, it normalizes good financial behavior and drives participation.

Increases feature adoption.

New features often go unnoticed. Gamification through tooltips, spotlights, and reward-based feature discovery guides users to explore capabilities they'd otherwise miss.

Best Gamification Strategies for Fintech Apps: 5 Proven Examples

1. CRED – Spin the Wheel

What it is: CRED, India's leading credit card payment platform, uses a daily spin-the-wheel mechanic that gives users 10 chances to win rewards like Bitcoin, gift vouchers, and cashback.

Why it works: Spin-the-wheel taps into variable reward psychology—the same mechanism that makes slot machines compelling. Users see potential rewards upfront, creating anticipation. Transparent odds make it feel fair rather than manipulative. The daily limit (10 spins) creates scarcity, encouraging users to return every 24 hours.

The result: CRED combines this with CRED Coins (earned through bill payments) and CRED Games, building a comprehensive gamification ecosystem that keeps premium credit card users engaged daily.

Key insight: Instant gratification mechanics work best when tied to core user actions (like paying bills on time).

2. Revolut – Competitive Leaderboard

What it is: Revolut's global financial super app uses a points leaderboard where users earn points for transfers and payments. Your position is tracked against both top performers and your friends, with points contributing to a weekly £1-£10,000 cash prize raffle.

Why it works: Leaderboards leverage social comparison theory—we're motivated by seeing how we stack up against peers. According to Forrester Research, competitive mechanics increase transaction frequency by 28% when users can see friend comparisons (not just anonymous rankings).

The result: Users make more transactions to climb the leaderboard, and the weekly raffle adds an element of chance that keeps even lower-ranked users engaged.

Key insight: Friend-based leaderboards outperform anonymous ones by 3:1 in driving sustained engagement.

3. Intuit Mint – Progress Bar Tracking

What it is: Mint visualizes spending against budgets using progress bars that fill as you spend throughout the month. Green bars indicate you're on track; yellow and red signal you're approaching or exceeding limits.

Why it works: Progress bars tap into the endowed progress effect—a psychological principle where visible progress toward a goal increases motivation to complete it. Seeing a budget bar at 60% full creates urgency to stay under budget.

The result: Users who engage with Mint's progress bars are 2.3x more likely to stay within budget compared to users who only view raw spending numbers (according to Intuit's internal data).

Key insight: Visual progress indicators work best when updated in real-time and paired with clear consequences (overspending alerts).

4. Fortune City – Achievement Badges

What it is: Fortune City gamifies budget tracking as a city-building simulation. Track expenses to construct and manage a virtual town, earning badges like "Master of Saving" when you outperform friends in specific savings categories.

Why it works: Badges create social proof and trigger dopamine release—the same neurotransmitter associated with reward and pleasure. According to behavioral science research, achievement badges increase task completion rates by 35% when tied to specific milestones.

The result: Fortune City transforms the tedious act of expense logging into a creative, competitive experience that users actually enjoy.

Key insight: Badges should celebrate meaningful achievements, not trivial actions. "Saved $1,000 in three months" is compelling; "logged in 10 times" is not.

5. CoinDCX – Milestone Mechanics

What it is: India's leading crypto investment app uses streaks and milestones to show users their progress through trading journey levels. Consistent app usage unlocks subsequent levels with added privileges like priority customer support and lower trading fees.

Why it works: Streaks leverage loss aversion, the psychological principle that we fear losing progress more than we value equivalent gains. Missing a single day resets your streak, creating powerful motivation to check in daily, even briefly.

The result: According to industry benchmarks, streak and milestone based mechanics increase daily active users by 40-60% in the first month of implementation.

Key insight: Streaks and milestones work best when meaningful rewards are tied to milestone numbers (7-day, 30-day, 100-day streaks) rather than just counting indefinitely.

How to Choose the Right Gamification Strategy for Your Fintech App

Not all gamification mechanics fit every fintech use case. Here's how to choose:

For daily engagement goals: Use streaks and daily rewards (spin-the-wheel, check-in bonuses). Best for credit card apps, investment platforms, and neobanks wanting habitual usage.

For competitive users: Implement leaderboards with friend comparisons and cash prize raffles. Ideal for payment apps, trading platforms, and cashback programs.

For goal-oriented features: Deploy progress bars and milestone badges. Perfect for budgeting apps, savings challenges, and debt payoff tools.

For education and onboarding: Use interactive challenges, quizzes, and achievement systems. Great for introducing complex features like investment portfolios or credit building.

For premium tier conversion: Apply level-up systems where advanced features unlock through consistent usage. Effective for freemium fintech models.

Best Practices for Fintech Gamification in 2025

According to Gartner's 2024 research, successful fintech gamification follows these principles:

- Tie rewards to meaningful actions. Don't gamify for the sake of it. Reward behaviors that benefit users (saving money, paying bills on time, learning about investments).

- Keep mechanics transparent. Financial services require trust. Always show odds, explain how rewards work, and avoid manipulative dark patterns.

- Balance competition with personal progress. Not everyone wants to compete. Offer both social leaderboards and personal achievement tracking.

- Make rewards valuable. Trivial prizes (like virtual stickers) don't move the needle in fintech. Focus on cash incentives, fee waivers, interest boosts, and exclusive access.

- Test and iterate quickly. A/B test different gamification mechanics to see what resonates with your specific audience. What works for Gen Z crypto traders won't work for Millennial budget planners.

Build Your Unique Fintech Gamification Experience with Plotline

Here's the challenge: Traditional gamification implementation takes months of dev work, complex backend integrations, and constant iteration based on user feedback.

You shouldn't wait that long.

Plotline's no-code in-app engagement platform lets product and growth teams launch gamification features in days without dev bottlenecks.

Integrate interactive elements like:

- Spin-the-wheel rewards for daily engagement

- Scratch cards for surprise incentives

- Confetti animations to celebrate achievements

- Progress bars for savings goals and milestones

- Tooltips and spotlights to guide feature discovery

- Stories and PiP videos to educate users about financial concepts

- Custom UI components tailored to your brand

The best part? Everything runs natively in your app, with full control over triggers, targeting, and personalization without changing any code.

Book a demo with Plotline to discuss how to boost engagement and retention for your fintech app with gamification that actually works.

Frequently Asked Questions About Fintech Gamification

Q. What is gamification in fintech?

Gamification in fintech is the strategic application of game design elements like points, badges, leaderboards, progress bars, and reward systemsto financial applications. The goal is to make routine financial tasks more engaging, motivating users to build better money habits while increasing app retention and feature adoption.

Q. Does gamification actually improve fintech app retention?

Yes. According to Deloitte's 2024 Digital Banking Report, fintech apps with gamification features see 47% higher 90-day retention rates compared to traditional banking interfaces. The key is tying game mechanics to meaningful financial behaviors rather than superficial engagement metrics.

Q. What are the best gamification features for fintech apps in 2025?

The most effective gamification strategies include: streak mechanics for daily engagement (like CoinDCX), spin-the-wheel rewards for instant gratification (like CRED), competitive leaderboards with cash prizes (like Revolut), progress bars for goal tracking (like Intuit Mint), and achievement badges for milestone celebrations (like Fortune City).

Q. How do I implement gamification without a development team?

No-code platforms like Plotline allow product and growth teams to design and launch gamification features without developer involvement. You can create interactive elements like scratch cards, progress bars, reward systems, and educational tooltips that integrate directly into your existing fintech app, typically going live in hours rather than months.

Q. Are there regulatory concerns with fintech gamification?

Transparency is critical. In regulated financial services, gamification must avoid manipulative design patterns and clearly disclose odds, terms, and conditions for any reward-based mechanics. Always consult with your compliance team when implementing features like prize draws, lotteries, or cash incentives to ensure alignment with local financial regulations.

Q. What's the difference between gamification and game-based learning in fintech?

Gamification applies game mechanics to existing financial tasks (like earning points for bill payments). Game-based learning uses actual games to teach financial concepts (like a simulation where you manage a virtual budget). Both have value, but gamification typically drives higher ongoing engagement because it's integrated into daily app usage.

Sign up for our newsletter

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Improve app adoption with Plotline

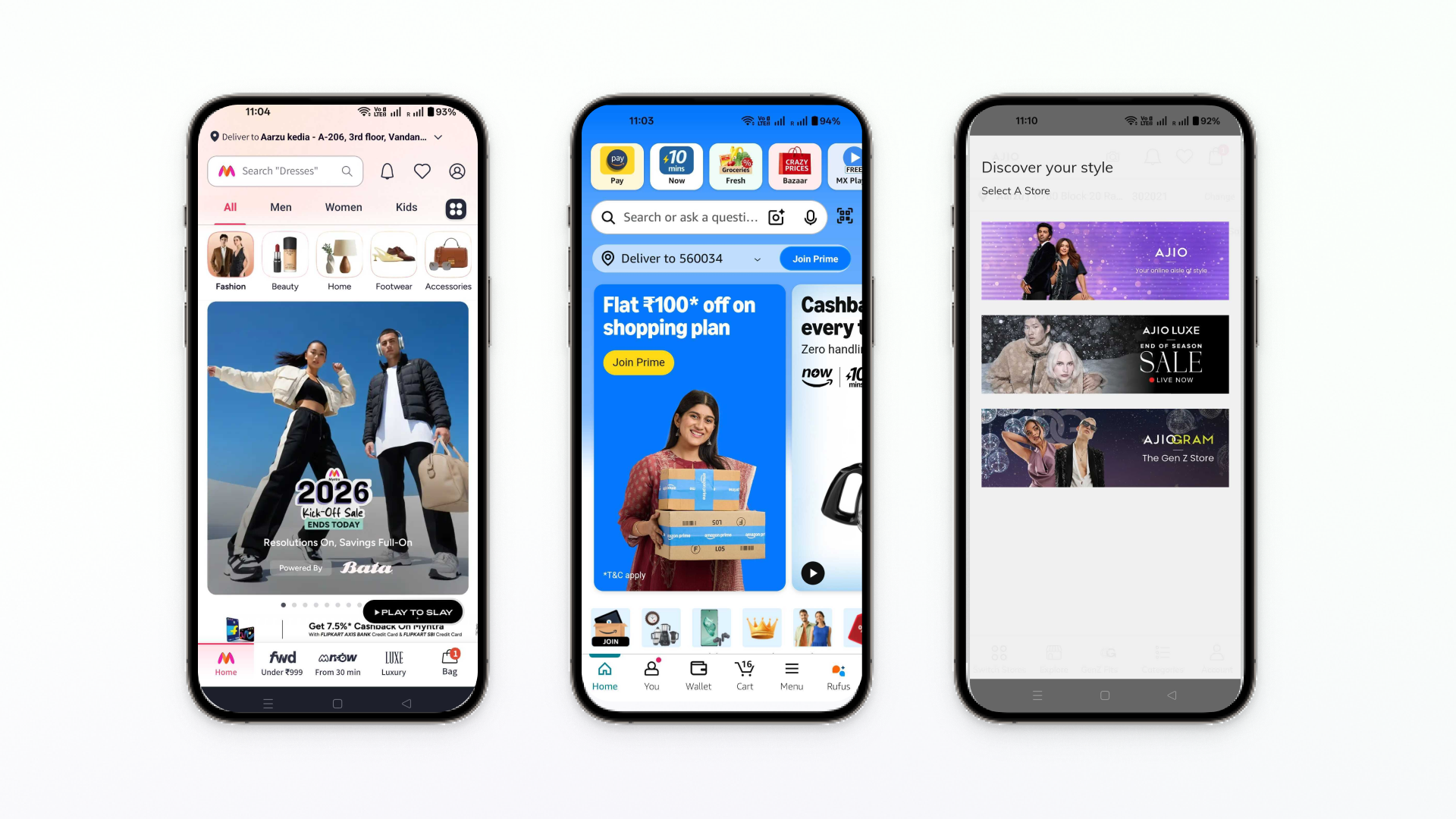

Join companies like Zepto, Meesho, Upstox and others that use Plotline to test and launch app experiences and boost activation, retention and monetization.

.png)

%201.svg)

%201.svg)

%201.svg)

.jpg)

.png)